As we step into the dawn of a new decade, the world of financial technology (fintech) is undergoing a drastic transformation, fueled by the power of artificial intelligence engineering.

The convergence of machine learning in financial technology is revolutionizing the way we manage, invest, and process financial transactions. With AI’s integration in decentralized finance (DeFi) and the rapid pace of fintech innovation, the landscape of financial services is poised to be redefined for the year 2024, and beyond. In this article, we will explore the impact of AI in fintech, the role it plays in decentralized finance, and the potential transformations that lie ahead for the financial services industry.

So, fasten your seatbelts as we embark on a journey to discover how AI is reshaping the world of finance in the years to come.

The financial services world is changing fast, thanks to AI in Fintech. By 2024, artificial intelligence will bring new chances for better efficiency and personal touch. This change is making how we deal with money services better for everyone.

Big names in finance are using new tech to keep up with what people want. They’re changing old banking ways. Fintech innovation is more than just a trend; it’s changing the way we think about money services.

Key Takeaways

- AI in Fintech is creating significant efficiencies in financial services.

- Artificial intelligence enhances personalization in banking and financial interactions.

- The year 2024 will see accelerated fintech innovation driven by AI technologies.

- Advanced analytics are optimizing consumer experiences and service delivery.

- Traditional banking models are evolving with the incorporation of AI solutions.

The Role of AI in Fintech Innovation

AI is changing the financial services sector in big ways. It makes operations more efficient and helps engage customers better. By using ai fintech solutions, companies see big changes in how they work. AI helps make better decisions and gives users more personalized experiences.

Understanding AI’s Impact on Financial Services

AI has a huge effect on financial services. It uses machine learning and predictive analytics to handle lots of data. This leads to smarter decisions and less risk. Financial services use AI to make customer interactions smoother, automate tasks, and cut down on mistakes.

This means transactions happen faster, are more accurate, and costs go down.

Key Areas of Fintech Transformation through AI

AI is changing many areas in financial services. These areas include:

- Customer Service: AI chatbots and virtual assistants make customer support instant and personal.

- Risk Management: AI looks at patterns and predicts risks, helping companies manage risks better.

- Product Offerings: AI helps create financial products that fit what customers need, making them happier.

These changes show how ai fintech is driving innovation in financial services.

| Area | AI’s Contribution | Benefits |

| Customer Service | AI chatbots | 24/7 support, reduced wait times |

| Risk Management | Predictive analytics | Enhanced decision-making, reduced losses |

| Product Offerings | Personalized recommendations | Improved customer satisfaction, increased sales |

Machine Learning in Financial Technology

Machine learning has changed how banks and other financial groups handle risks and improve customer service. It lets them analyze huge amounts of data better. This leads to more precise risk assessments and services that are more suited to each customer.

How Machine Learning Improves Risk Assessment

Financial groups use machine learning to make their risk assessment better. They look at past data to find patterns that show risks. This helps them act before problems happen, making decisions smarter and keeping finances stable.

Enhancing Customer Experiences with Predictive Analytics

Predictive analytics is key to making customer experiences better in finance. Banks use customer info to offer services that fit each person’s needs. This makes customers happier and more loyal by making their experience more personal.

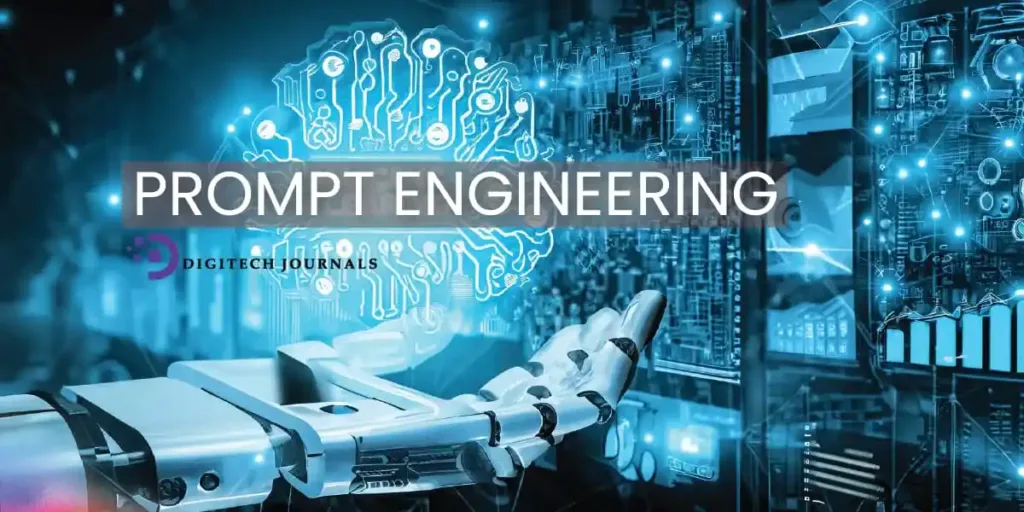

AI in Fintech: Overhauling Automated Investment Platforms

The financial world is changing fast, with more people using automated investment platforms. Robo-advisors started in 2024 and changed how we handle our investments. They offer a cheaper and easier way to manage money compared to traditional financial advisors.

The Rise of Robo-Advisors in 2024

Robo-advisors use AI and complex algorithms to offer personalized investment advice. They’ve become very popular because they’re easy to use and don’t cost a lot. People who want to manage their money smartly can now use these automated tools that used to need a lot of human help.

Many robo-advisors use machine learning to get better at understanding the market. This lets them change investment plans quickly to keep up with the market.

Benefits of Using AI for Portfolio Management

Using AI for managing money has many benefits. Investors get:

- Improved Portfolio Optimization: AI algorithms look at lots of data to give advice on how to spread out investments better.

- Real-Time Performance Tracking: These platforms let users see how their investments are doing at any time. This helps them make quick changes if needed.

- Reduced Human Error: Because these systems run on their own, they cut down on mistakes that people might make when managing money.

| Feature | Robo-Advisors | Traditional Advisors |

| Cost | Low management fees | Higher fees |

| Accessibility | Available 24/7 through platforms | Limited hours |

| Customization | Algorithm-driven recommendations | Personalized advice from humans |

| Investment Strategy | Data-driven | Experience-based |

These changes show how automated investment tools and robo-advisors can help investors. By using AI for managing money, people get better insights and strategies in the fast-changing financial world.

Digital Banking Solutions Powered by AI

Digital banking is changing fast, thanks to AI. Banks are using artificial intelligence to make things run smoother and improve how customers feel. This change makes banking easier and gives users tools to manage their money better.

How AI Enhances Personal Finance Management

AI is changing how we handle our money. Now, banking apps have cool features like tracking expenses, budgeting tools, and advice based on what you do. These tools look at how you spend money and suggest ways to save. This helps people make better money choices easily.

The Future of Customer Service in Digital Banking

Customer service in digital banking is getting a big boost from AI. Chatbots and virtual assistants are everywhere, answering questions fast and helping out any time. These tools cut down on waiting and make services available all the time. Plus, AI gets better at helping you over time by learning from what you say.

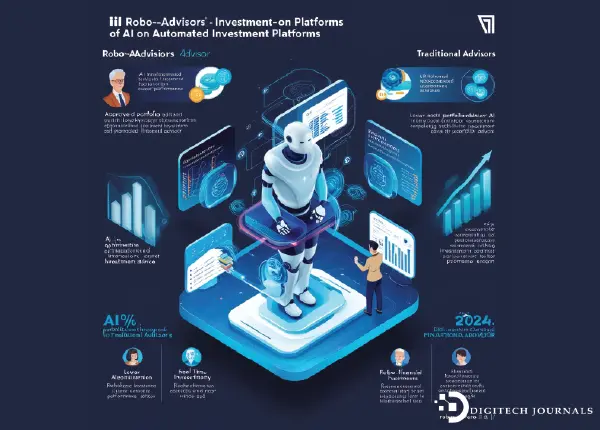

Deep Learning Algorithms in Financial Services

Deep learning algorithms are changing financial services a lot. They help with fraud detection and credit scoring. These algorithms use advanced neural networks to look through lots of data. They find hidden patterns and anomalies.

Application of Deep Learning in Fraud Detection

Fraud detection is where deep learning really stands out. Old methods can’t keep up with fraudsters’ new tricks. Deep learning algorithms make fraud detection better by:

- Real-time analysis of transactions to find suspicious ones.

- Looking at many factors, like transaction history and user behavior.

- Using pattern recognition to find oddities that might mean fraud.

Transforming Credit Scoring with Deep Learning

Deep learning is changing credit scoring too. It lets financial institutions:

- Use more detailed data, like social media and payment histories.

- Make very accurate credit scores with more variables.

- Reduce bias in old scoring systems for fairer assessments.

| Aspect | Traditional Methods | Deep Learning Algorithms |

| Speed | Slower analysis | Real-time detection |

| Data Utilization | Limited data points | Extensive data integration |

| Accuracy | Higher false positives | Reduced false positives |

| Adaptability | Static models | Dynamic learning and improvement |

Deep learning is changing financial services a lot. It’s making a big difference in how we detect fraud and score credits.

Automated Trading Systems and AI Integration

AI has changed how we invest by making automated trading systems better. These systems use advanced algorithms to make trades quickly and precisely. This is much faster and more accurate than traditional methods.

Algorithmic Trading: Key Benefits for Investors

Algorithmic trading offers many benefits to investors. These include:

- Increased efficiency: Trades happen in milliseconds, getting the best prices.

- Reduced emotional impact: Algorithms make decisions based on data, not feelings.

- Backtesting capabilities: Traders can test strategies with historical data first.

- Diverse strategies: Algorithms can use many strategies at once, making portfolios more diverse.

How AI Predicts Market Trends

AI changes how we see market trends. It looks at huge amounts of data to find patterns and connections. This helps investors make better choices by looking at:

- Historical data analysis: Past market data helps predict future trends.

- Real-time data processing: Analyzing current market data helps make quick decisions.

- Sentiment analysis: AI looks at social media and news to understand market feelings and predict changes.

The Impact of AI on Compliance and Regulatory Challenges

AI technology is changing how fintech deals with compliance challenges. It can look at huge amounts of data quickly. This helps financial groups make their regulatory work smoother. By using AI to automate, groups can work better and cut down on mistakes.

Automating Compliance Processes with AI

Financial groups are using AI to make compliance easier. These systems handle tough reports and watch over things closely. This means they can quickly meet regulatory needs. The main benefits are:

- Improved accuracy: AI cuts down on mistakes in reports and handling data.

- Time savings: Automation makes compliance work faster, letting staff focus on important tasks.

- Regulatory adaptability: AI can quickly change to new rules and standards.

Ensuring Data Security and Privacy in AI Solutions

As fintech uses more AI, keeping data safe is key. Financial data is very sensitive, so privacy and cybersecurity are big concerns. To protect personal info and gain customer trust, companies use strong data protection plans. These include:

- Encryption: Use encryption to keep data safe when it moves and when it’s stored.

- Access controls: Only let certain people see sensitive data to stop unauthorized access.

- Regular audits: Check for weak spots and make sure data protection rules are followed.

| Compliance Challenge | AI Solution | Benefits |

| Regulatory Reporting | Automated Data Extraction | Increased accuracy and efficiency |

| Fraud Detection | Predictive Analytics | Early spotting of suspicious actions |

| Privacy Violations | Data Encryption | Better data security |

| Policy Compliance | Continuous Monitoring | Real-time check on compliance |

Using AI in fintech helps with automating compliance and solving big data security issues. By using AI, financial groups can handle complex compliance needs and protect customer data well.

AI’s Integration in Decentralized Finance (DeFi)

AI is changing how financial services work in DeFi. It brings new solutions to the table. Smart contracts with AI make transactions faster and cut out middlemen.

This leads to better lending and borrowing and safer exchanges. It makes financial services more accessible to everyone.

Innovative Financial Solutions through DeFi and AI

DeFi and AI together open up new ways to finance. Automated lending uses AI to check credit fast and safely. This means loans get approved quicker and with less risk.

AI also helps manage money better. It gives users the info they need to make smart choices right away.

Asset Management and AI in the DeFi Space

AI plays a big part in managing assets in DeFi. It helps investors make better choices with risk tools. Automated trading cuts down on mistakes, which can lead to more profits.

Conclusion

AI has changed the way financial services work, making them more efficient and customer-focused. This article showed how AI is more than just a tool; it’s a big change in finance. It’s making financial services better, safer, and more focused on what customers need.

The world of fintech is always moving fast. Everyone in the industry needs to use new AI technologies to stay ahead. Using AI for things like risk management and talking to customers will be key to success. As we move forward, AI will keep changing finance in big ways.

AI and fintech together will change how services are given and make things better for customers. Companies that use AI well will do great in this new world. They will lead in finance with their smart use of AI.

FAQ

What is the role of AI in fintech?

AI is changing finance by making things more efficient and personal. It helps with better decision-making and improves how customers experience financial services. This leads to more innovation in traditional banking.

How does machine learning impact financial technology?

Machine learning helps fintech by making risk assessment more accurate. It looks at past data to spot risks. It also makes customer experiences better by offering personalized advice based on what users do.

What are robo-advisors, and how do they benefit investors?

Robo-advisors are online platforms that manage investments automatically. They offer affordable financial advice. They track investments in real-time and use data to make smart choices, cutting down on mistakes.

How is AI changing digital banking solutions?

AI is making digital banking better by adding tools like expense tracking and budgeting. It also improves customer service with chatbots and virtual assistants. This makes interacting with banks smoother.

What is the importance of deep learning algorithms in finance?

Deep learning algorithms are key in spotting fraud in finance by looking at big data for unusual patterns. They also improve credit scoring by using detailed data for a more accurate look at creditworthiness.

How do automated trading systems benefit from AI?

Automated trading uses AI to make trades at the best times, reducing risks for investors. AI’s deep analysis of data helps predict market trends. This lets investors adjust their plans better.

What are the compliance challenges associated with AI in finance?

Adding AI to finance brings up new challenges in following rules and regulations. Automating compliance makes reporting easier. But, it also means needing strong data security to protect information and keep consumer privacy safe.

How is AI integrated into decentralized finance (DeFi)?

AI helps DeFi by making things like smart contracts and automated lending safer and easier to use. It also improves managing assets in DeFi by offering better risk checks and automated trading.